Today,

nothing is hotter than a “Lean Startup”. The general concept goes something like this:

The runway of a startup is not defined by a period of time, but by a number of pivots. To be successful, the startup should therefore, aggressively pursue pivot opportunities through early commercial exposure through “minimum viable products” (the clougiest thing that the startup can get anybody to actually buy). In other words, guessing what technology is going to work in the market is hard, so it is better to setup your company so you can aggressively test your ideas.

At Rebound we have tried (as difficult as it is in Cleantech) to adopt this strategy in each of our technologies. Still, we get a LOT of pressure to do things "leaner" and I think that we are reaching the point where, at the very least, every entrepreneur on the planet has at least heard of the "lean" concept. The next step is obvious, and will likely be significantly more difficult: create a lean VC process to accompany the lean startup. So, what would that look like? Lets figure it out!

I have talked before about how terrible the the current investor system is at selecting good startups so I won't belabor that point here. It's bad. What I want to introduce is a different type of process. Currently, the process is niche-y. VCs, angels, and strategics all try to invest in certain size companies at certain times in their growth. At each stage, these group rely on their own brief (but at times thorough) research, company pitches, and intuition to decide what companies to invest in. This method does not lead to particularly stunning results as most (80%) investments don't yield any kind of return.

Clearly there is huge room for improvement in this system: If a new system was successful twice as often as the current system, it would still fail 60% of the time. A new system that still failed half the time would be 150% better. Is it outrageous to think that we could create a system that picks winners just 50% of the time?

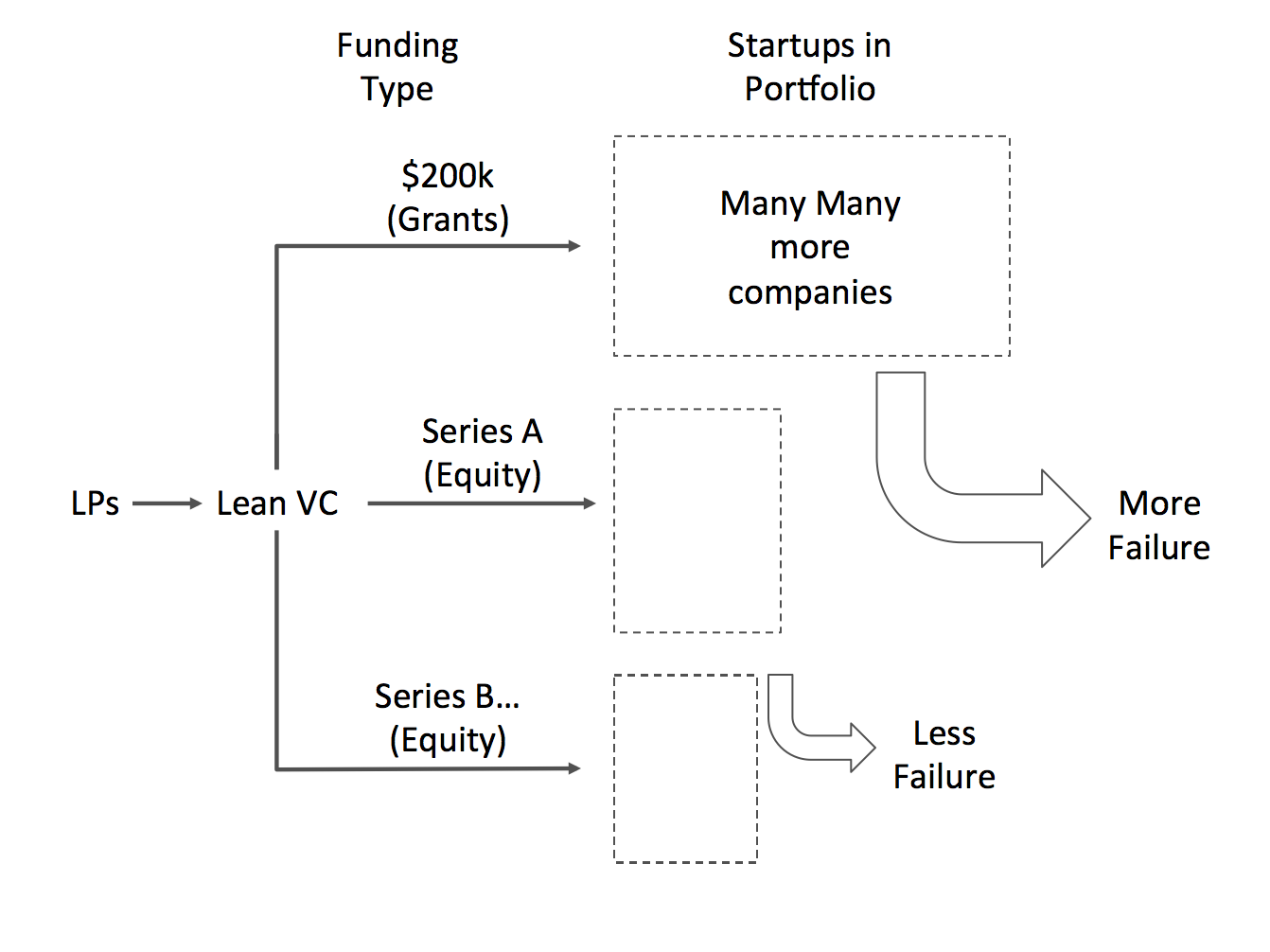

The lean VC has the same underlying idea as the lean Startup: guessing who will be successful or fail is hard, so try as quickly and repetitively as you can. To be clear, the lean VC is not an incremental improvement over the current VC model. Let's start with a block diagram of how a lean VC model can increase return by shift failure up the startup life:

The runway of a startup is not defined by a period of time, but by a number of pivots. To be successful, the startup should therefore, aggressively pursue pivot opportunities through early commercial exposure through “minimum viable products” (the clougiest thing that the startup can get anybody to actually buy). In other words, guessing what technology is going to work in the market is hard, so it is better to setup your company so you can aggressively test your ideas.

At Rebound we have tried (as difficult as it is in Cleantech) to adopt this strategy in each of our technologies. Still, we get a LOT of pressure to do things "leaner" and I think that we are reaching the point where, at the very least, every entrepreneur on the planet has at least heard of the "lean" concept. The next step is obvious, and will likely be significantly more difficult: create a lean VC process to accompany the lean startup. So, what would that look like? Lets figure it out!

I have talked before about how terrible the the current investor system is at selecting good startups so I won't belabor that point here. It's bad. What I want to introduce is a different type of process. Currently, the process is niche-y. VCs, angels, and strategics all try to invest in certain size companies at certain times in their growth. At each stage, these group rely on their own brief (but at times thorough) research, company pitches, and intuition to decide what companies to invest in. This method does not lead to particularly stunning results as most (80%) investments don't yield any kind of return.

Clearly there is huge room for improvement in this system: If a new system was successful twice as often as the current system, it would still fail 60% of the time. A new system that still failed half the time would be 150% better. Is it outrageous to think that we could create a system that picks winners just 50% of the time?

The lean VC has the same underlying idea as the lean Startup: guessing who will be successful or fail is hard, so try as quickly and repetitively as you can. To be clear, the lean VC is not an incremental improvement over the current VC model. Let's start with a block diagram of how a lean VC model can increase return by shift failure up the startup life:

In the Lean VC model the VC realizes they can't play in just one step of the process. The risk for investment comes from misjudgment about a technology, team, market, or some combination there of. The problem is that these things are impossible to accurately assess in the current VC model. The pitch, hob-nob, underling market research approach is a mockery. Companies with amazing technology are passed over because the technology is not easily understood, and teams with no experience are passed over because they have no credibility. The Lean VC, on the other hand, understands that the things that make startups succeed or fail can't be measured that easily. The only thing to do is try, a LOT.

In the Lean VC model, the first round of funding is equity free. That is right. Some small grant is given to the startup for no equity with the goal of funding the companies for about 1 year. The only stipulation is that the Lean VC is given a right of first refusal for a Series A. Why would a VC do this? On the surface it seems like a missed opportunity, but in reality it is a way for the Lean VC to move the risk to a point in the process where the cost of that risk is very low. The Lean VC is buying the information it actually wants, the knowledge of what company to invest in for a series A.

Lets look at an example comparison between two $50M funds.

A Traditional VC would invest in 10 series A companies each for about $5M. It tries its best to vet these companies using the approach we use today. These VCs are not dumb, they are up against an impossible task. In the end 80% of these companies are going to fail at a loss of $40M. That is a big hit. Hopefully the successes were enough to make up for that.

The Lean VC, uses $5M and gives out 200k grants investing fast and loose in 25 companies. To make these investments, the VC understands they will make 80% poor choices using the old rules. It can do this, because these are not risking investments. The VC knows that, in the end, it only wants to make nine $5 series A investments, meaning that 64% of their current grant portfolio will not be invested in.

At this point the VC has already spent $5M and it has no ownership yet, but what it has done is created a group of companies which it can monitor for the traits it is looking for quantitatively. The VC is able to work with its grantees to monitor their milestones, team, market, and to absolutely understand why their technology is amazing, or total crap. In the end, the VC has to choose 9 of those 25 companies to invest Series A money in. The lean VC only needs to do 2% better during this choice to come out ahead of the traditional VC.

During the grant funded year, the VC finds 9 companies it wants to invest further in by eliminating the underperformers. Lets just pretend that the VC does a good job of this and it does not eliminate any winning companies. This means that, of the 9 companies it invests in 4 will be losers and 5 will be winners, bumping up the success rate of the fund to 50% even taking into account the wasted grant money.

Clearly this is an academic example of how the Lean VC might significantly outperform a traditional VC. But the fundamental question comes down to the difference between the intuition of an individual and a process based on testing and quantitative analytics. Wether it is Money Ball, The Lean Startup, or MIT Hedgefunds this question has been answered a lot in the past 10 years. Spoiler alert, the individual intuition always looses.

No comments:

Post a Comment